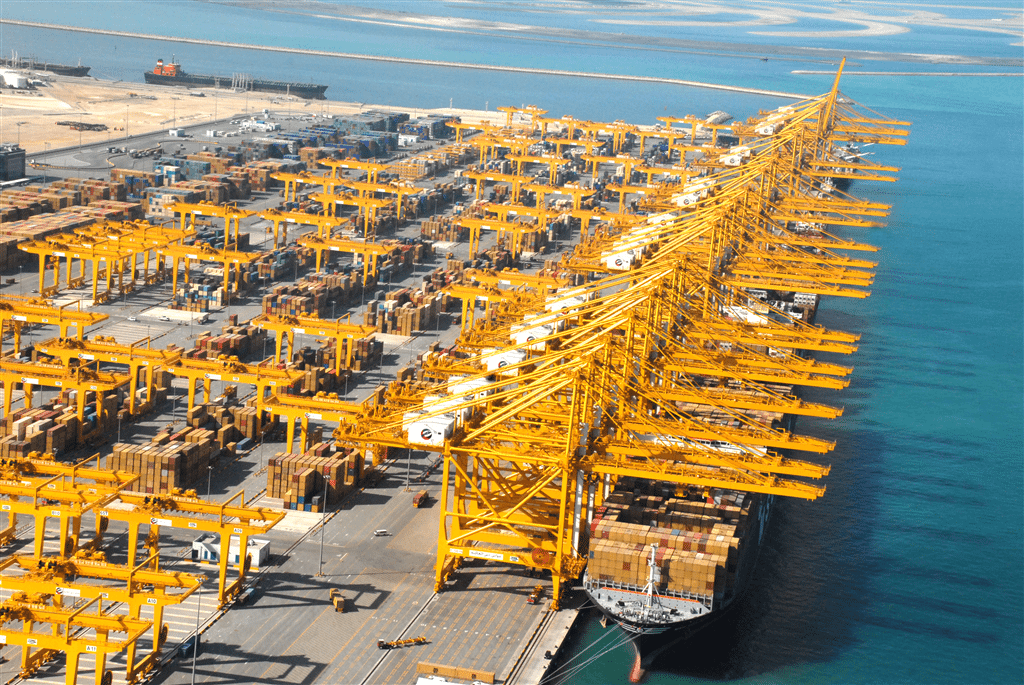

The UAEs industrial and logistics space is increasingly attracting global investor interest, with the recent sale-and-leaseback of Transworld Groups logistics facility in Jebel Ali Free Zone, Dubai, showcasing positive investor sentiment signalling future growth in the sector, a report from JLL has found.

The rise in e-commerce and the subsequent digitisation of the supply chain industry are the major factors fuelling growth and investor interest for high quality assets in the industrial logistics space, the real estate and investment management services firms, said the report.

In the long run increased capital investments of this scale will drive future development of quality space, fulfilling demand for warehouse facilities across the UAE. The logistics sector is attracting significant interest from institutional investors, asset managers, REITs and private family offices seeking long term returns that are backed by quality tenants while retaining little or no management responsibility for the real estate, said Abdul Kader Monla, Director, Capital Markets in MENA, JLL.

A recent major transaction, advised by JLL, was the sale-and-leaseback of Transworld Groups facility, a high-quality warehouse and office property spanning over 19,000 square meters that will continue to be occupied by the prominent 3PL operator, he added.

We expect to see an increasing number of future trades given the unique value proposition and attractive attributes of the sector, particularly in todays tight market conditions.

JLL is currently advising a number of firms considering asset light strategies, allowing greater returns through reinvesting the sale proceeds into their core business. When compared to traditional debt, alternative funding structures can allow for higher capital release while minimising cash outflow, Monla concluded.